A bridge loan is short term loan that helps cover unexpected business costs while your business secures a long-term loan or permanent financing. This is ideal for businesses that need quick access to cash flow while in that time gap between applying for a long-term loan and receiving funds. Here at Nebula Finance, our bridge loans are simple, giving businesses quick access to capital for their business needs. We understand that sometimes the loan process can take time, and securing long-term financing can be a more extensive process than a short-term loan.

Need to secure capital fast? Our bridge loans start at $5,000 and range up to $1 million. Our payment options are super flexible with automatic daily, weekly or monthly payments withdrawn from the business bank account on file*. Another great feature is that you can apply from almost anywhere all through our online portal. If approved, this portal will also be available to you any time so you can always review your account from your device.

Loan terms starting at 3 months ranging up to 60 months.

An interest charge or fixed fee will be charged. Other fees may also be charged.

All you need are 3 important things to apply.

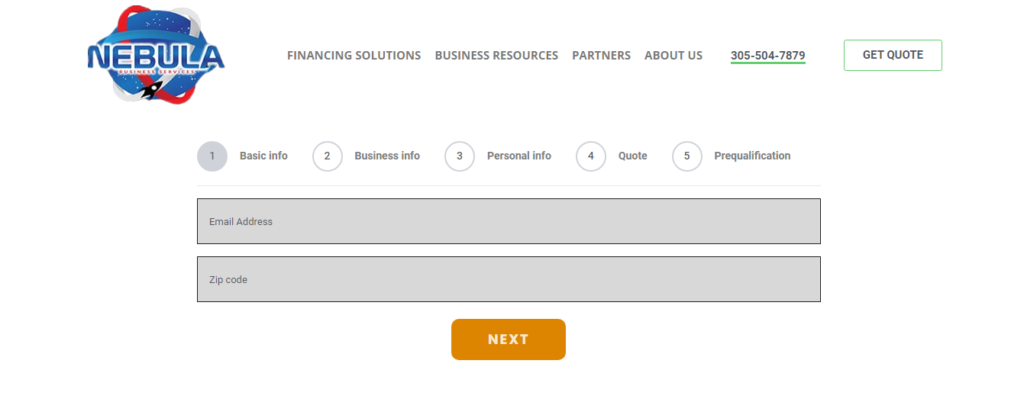

You can apply online from anywhere and on your device. Just click the GET QUOTE button at the top of the page. Let us know about your company and your goals, and remember to collect the necessary documentation.

Our team will review all the information provided to us. If we need additional information, our team of business advisors will reach out to let you know.

If approved, our team will proceed to send out the approved funds to your business bank account.

A bridge loan works by providing approved business applicants access to capital in a very fast and convenient way while the business attempts to secure permanent long-term financing. It gives businesses access to lump sum of capital during that gap between applying and getting approved for a long-term loan. Similar to a small business loan, with a bridge loan businesses may benefit from receiving funds in a lump sum with fixed payments and fixed terms. The main difference is that a bridge loan is considered a short-term loan while a small business loan is typically long-term.

Getting a bridge loan is a very similar process as getting a small business loan. There are certain requirements that must be met in order to apply. Most business financing companies require the following in order to apply for a bridge loan: certain time in business, business bank account, business revenue, some sort of identification, which can be a driver’s license or passport.

Having bad credit does not automatically mean that your application for a commercial bridge loan financing will be denied. It is true that most small business funders may use credit as a factor when reviewing applications, however, your bad credit may not be a determining factor as to whether the application gets approved or not. The truth is that there are many factors that business funders may take into consideration when deciding to approve an application. Some of these additional factors may be and are not limited to the performance of the small business, which can be determined by the business revenue, the time in business, the accounts receivables, and the business credit history.

Nebula Finance offers a financing calculator that will give you an approximate estimate as to how much your business may qualify for depending on your response to the few questions we ask. Our calculator will let you select the desired working capital amount, your credit score, and the business’s monthly sales which then allows you to see what your small business may qualify for depending on the information provided; however, additional information may be required.

Click here for immediate access to the bridging loan calculator.

A bridge loan can be great for businesses that need quick access to capital while securing a permanent long-term loan. Other reasons why our clients love our bridge loans is due to the quick access to capital, the flexible payment options, and terms ranging from three months up to sixty months.*

One possible con for a bridge loan is the fact that it is short-term. This might not be the best option for a business looking for a long-term loan that would span of several years. However, at Nebula Finance we do offer a small business loans that can be long-term and the application process is almost the same as a bridge loan.

There are a few things to keep in mind before applying for a bridge loan. The first should be the reason why your business needs the loan, how much working capital does your business need, and lastly, the repayment terms that your business can afford. This will help you navigate whether your business needs a long-term loan or short term loan. Other things to keep in mind before applying is what your current credit score situation is (the higher the score the better), how fast do you need the funds, has your business been in operation for over two years, do you have over a year of business bank statements, etc. These will be some of the questions asked during the application process and depending on the response your business may or may not qualify for approval.

Nebula Finance © 2022 All rights reserved. Nebula Financial is a registered tradename of Nebula Financial Services, and LLC.