A merchant cash advance gives a business access to capital fast to meet their business needs based on future credit card receivables. The way this business cash advance works is it gives a business access to funds in a fast and simple way in return for a portion of the business’s future revenue receivables at a discounted price. To be approved for an MCA, certain criteria must be met. An important criteria, among others, is that the business must accept credit card payments or have other receivables.

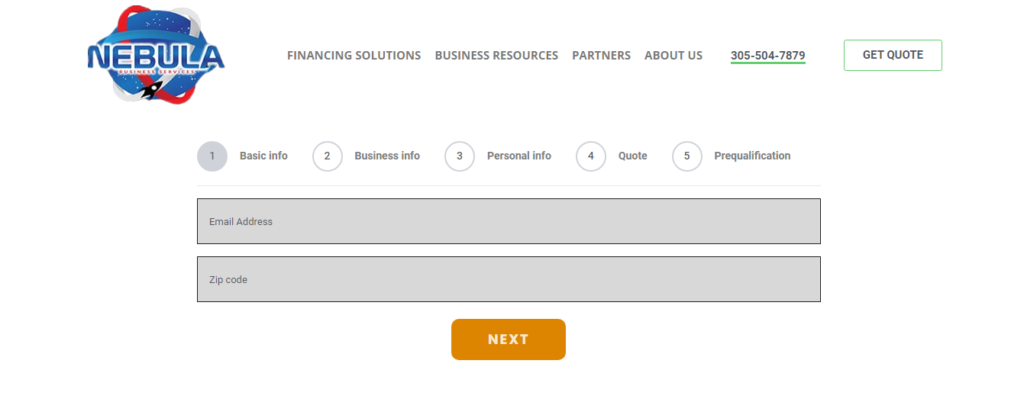

At Nebula Finance, applying for an MCA is very fast and convenient, and can be done from your mobile device, tablet, or computer. Applying can be done from our online portal and should take just a couple of minutes . Our merchant cash advance amount starts at $5,000 and can range up to $500,000.

Which business is ideal for this type of small business financing? Businesses who accept credit card payments and are in need of fast access to capital funds are ideal candidates. Remember, aside from being simple and have a much easier application process, a merchant cash advance provides flexibility. The reason an MCA provides flexibility is because the advance has variable payments based on business receivables. If your business has high credit card sales, lots of receivables, or is seasonal, then a merchant cash advance might be ideal for the business.

Automatic payments calculated based on a percentage of the business’ credit card sales or other revenue receivables

Payments are based on the businesses receivables so there is no fixed payment term

The receivables are purchased at a discounted price and fees may be charged and deducted from the advance amount

**An estimated completion date is calculated based on the estimated time it will take the business to deliver the receivables (which will vary based on the business’ performance). These estimated completion dates typically range between 3 months up to 18 months, but this is only an estimate.

All you need are 4 important things to apply.

Form of identity validation

Business bank account number and routing number for deposit

Last three months of business bank statements

Last three credit card processing statements

Our team will review all the information provided to us. If we need additional information, our team of business advisors will reach out to let you know.

If approved, our team will send the approved funds to your business bank account so be on the lookout as this can take a matter of minutes!

A merchant cash advance works by granting approved businesses access to working capital in return for their future credit card receivables at a discounted price. Small businesses can apply online in a fast and convenient way from their mobile, tablet, or computer. Once If approved, we will send the working capital to the business bank account provided in the application process.

While small business funding companies may use personal or business credit as a factor when looking at your small business financing application, it might not be a determining factor as to whether or not the business financing application is approved. Most small business funders may also take into consideration the overall performance of your small business by looking at the business revenue, time in business, accounts receivables, and business credit history.

Yes, a merchant cash advance is the same as a business cash advance, just different terminology, but the product provides the small business with access to working capital. A merchant cash advance or a business cash advance is a purchase and sales transaction where in the small business financing company purchases, at a discount, a portion of the small business’s future accounts receivables and the financing company is paid a percentage of those future accounts receivables.

A small business that wants to apply for a business cash advance must have accounts receivable such as credit/debit card sales, invoices, etc. The alternative funder will then proceed to review credit card processing statements, business bank account statements, invoices and more in order to approve the business for the merchant cash advance.

business can benefit from a small business cash advance as this allows access to quick working capital the business needs with very flexible payment options. A small business cash advance tends to be more flexible than traditional small business loans. This is ideal for businesses that are seasonal, or have high credit card sales or have a lot of receivables.

A merchant cash advance is a purchase and sale transaction, where a financing company is purchasing, at a discount, a portion of the small business’s future revenue stream (ie credit/debit card sales or accounts receivables). A small business loan is when a financing company lends money to a borrower and the borrower must repay the small business loan with fixed payments.

Here at Nebula Finance we are dedicated to the success of each of our clients. It’s simple, your success is our success. Therefore, we make sure we provide your business with the resources it needs to come up on top. Oh yeah, and let’s not forget the following!

Nebula Finance © 2022 All rights reserved. Nebula Financial is a registered tradename of Nebula Financial Services, and LLC.